Numbers tell part of our story.

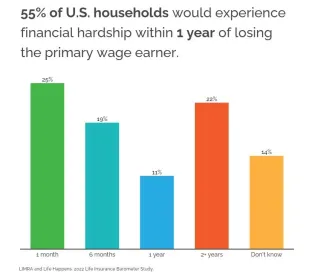

Do you know how long it takes for your loved ones to experience financial hardship if you passed away?

67,980,000 are in a financial crisis in one year or less after the death of a family member by Census Bureau numbers. † Insurance is a key element in feeling—and being—financially secure.

Personally, this was my parent's story. My dad had life insurance but no mortgage protection. The company took nearly a year to pay out. My mother had to sell the house before the insurance policy paid out and lost money on it. Our family couldn't afford their mortgage and ours. It's why we started our company.

†Based on 122,354,219 U.S. households according to U.S. Census Bureau data as of 2020, and the LIMRA study1 that 55% of households would face financial hardship in one year of losing the primary wage earner. 2Gusner, P. (2022, August 16). Average life insurance rates of 2022. Forbes.

We use trustworthy companies.

Not all companies are created equal. Good insurance matters. Among the insureds with financial dependents, 68% feel secure, compared with 47% of non-insureds.1 Consumers with overlapping sources of coverage—employer and individual—have the highest likelihood of feeling secure.2

We want you to feel and your legacy to be secure when your life story ends. We contract with 50+ A rated insurance carriers by AM Best rating the insurance industry since 1899. As state licensed and federally regulated brokers we make sure to use some of the best companies to insure our clients legacy, most generally pay out in under 30 days.

We work directly for our clients not the insurance companies. You become a client when we take an application and your family is protected. Some of our great American based and owned companies include:

United Home Life & United Farm Family

1 55% of households would face financial hardship in one year of losing the primary wage earner. 2Gusner, P. (2022, August 16). Average life insurance rates of 2022. Forbes.

Will's brief bio.

In my personal life. I'm a Christian. I'm a husband, dad to four, and I’m also a bi-vocational pastor. On Sundays, our family serves the Lord so the office is closed. If you want to learn more ask or click Meet Will and read more.

I strive to live by Hebrews 12:1-2.

What we will do.

1. To listen to you and make sure whatever options you choose are ethically your best and most affordable.

2. To show you options that will work for you now and tomorrow.

3. Apply for coverage.

Things you will need.

We are compliant with the Patriot Act so have your identification and US based banking information including routing and account number for automatic drafts. Some carriers require your driver's license and all carriers require your social security number to validate your identity.

A pen and paper, identification, a list of medication history if applicable, and a smile. Be ready to ask questions. Will assist 12-20 families a week. Please let him know if it is not a priority or if you have a timing conflict. If you cannot make please Will know so that he can open that time for another family that needs it. If he is helping another family then he will text you.

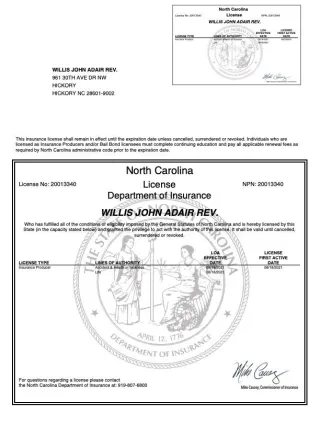

State insurance licenses.

NIPR 20013340

CALS 14042720

National Insurance Producer Registry https://nipr.com/licensing-center/look-up-a-national-producer-number

AL- 3003328176 , AR -20013340, AZ - 20013340, CA - 4232450,

CO- 869726 , DC- 3001935101, DE - 3003455639, FL - W929716, GA - 3632202,

IN - 3756207, KS - 20013340, , KY - 1296034, LA - 964787,

MA - 20013340, MO- 3002547804, NC -20013340, OH - 1397916,

PA - 1078396, RI- 3003561434, SC- 20013340, TX - 2717543, - VA - 1307910. Partners in all 50 states.

✝️ Believer 💰 Financial Peace Advocate

🤝 Need Help? Reach out.

(c) 2021-2025